In today's rapidly changing regulatory landscape, financial firms face immense pressure to maintain compliance while…

Key Compliance Priorities: Navigating the 2025 FINRA Regulatory Oversight Report

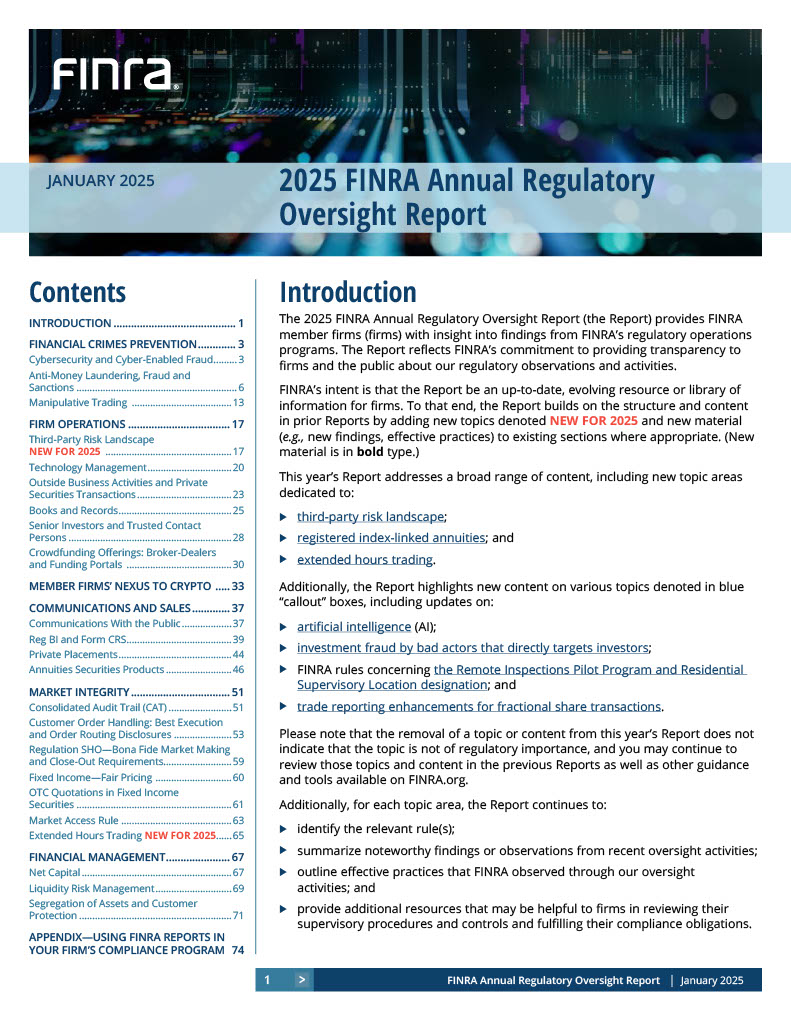

The 2025 FINRA Annual Regulatory Oversight Report identifies critical compliance priorities and emerging risks that broker-dealers, investment advisers, and financial institutions must address to stay compliant. To maintain compliance in this evolving landscape, firms must proactively strengthen their frameworks to address the latest FINRA updates and mitigate potential risks.

This year’s report emphasizes cybersecurity, Anti-Money Laundering (AML), third-party risk management, extended hours trading, and the increasing oversight of digital assets.

Regulatory Priorities and Emerging Risks

1. Cybersecurity and Cyber-Enabled Fraud: With cyber threats escalating, firms must bolster cybersecurity frameworks through robust monitoring and comprehensive employee training.

2. Anti-Money Laundering (AML) and Fraud Prevention: Enhanced AML compliance requires risk-based approaches to identify financial crimes, monitor transactions, and implement effective AML programs.

3. Third-Party Risk Management: As reliance on vendors grows, thorough due diligence, risk assessments, and stringent oversight policies are essential for managing third-party risks.

4. Extended Hours Trading: Firms must establish clear policies, conduct risk assessments, and implement surveillance for extended trading sessions.

5. Crypto and Digital Assets Oversight: Heightened regulatory scrutiny demands robust fraud prevention, transparent disclosure, and strong compliance for firms engaged with cryptocurrencies and blockchain assets.

Key Compliance Takeaways

- Strengthen risk management programs to proactively address cybersecurity and financial crime risks.

- Enhance supervision for broker-dealers and investment advisors through proper training and compliance enforcement.

- Refine AML compliance frameworks to align with the latest FINRA expectations.

- Adapt compliance strategies to stay ahead of evolving regulations and enforcement trends.

How Quadrant Regulatory Can Help

Quadrant Regulatory provides tailored regulatory compliance solutions for broker-dealers and investment firms, including:

- Proactive risk assessments and internal audits to ensure compliance with FINRA updates.

- Customized cybersecurity programs to prevent fraud and data breaches.

- Comprehensive AML compliance services to meet federal and state requirements.

Contact Quadrant Regulatory today for a compliance consultation and stay ahead of the evolving regulatory landscape.